South Gloucestershire Council’s (SGC’s) element of the council tax levied on local households is to increase by 2.99 percent from April.

The latest rise follows an uplift of 4.99 percent in 2021/22 and 3.99 percent in 2020/21, both of which included ring-fenced levies (3 percent in 2021/22 and 2 percent in 2020/21) to support adult social care.

The 2022/23 increase once again includes a social care levy, this time 1 percent, which is the maximum that could have been applied under government rules spanning the last two years.

The increase means that the South Gloucestershire Council element of council tax for a Band D property for 2022/23 will rise to £1,668.64.

A council spokesperson said:

“The priority in producing the budget for 2022/23 has been to deliver on residents’ priorities, while ensuring the council maintains a sustainable financial position.”

Key investments include an additional £639,000 for street cleaning, more than £12 million on road maintenance and an extra £15.3 million for children’s services.

A new £1 million ‘prevention fund’, focussed on promoting public health messages, will help people stay healthier for longer.

There will also be an extension of the council’s Community Resilience Fund, which is designed to provide support to those who continue to be impacted by the Covid-19 pandemic, including those who may not have been eligible for previous government support

Additional money from central government means that schools will share an extra £7.3 million of funding, with a total of £191 million being spent – an increase of 6.6 percent over 2021/22.

Investment in transport infrastructure over the next three years will see public transport improvements along the A38 and A432 corridors, a new park & ride on the M32 and a new railway station at Charfield.

Vital services protected

Cllr Toby Savage, leader of the council, said:

“This balanced four-year budget is one for everyone in South Gloucestershire. We are protecting the vital frontline services that so many people rely on and we are investing to create an even cleaner and greener South Gloucestershire. We want to secure our area’s future prosperity through investment in transport and infrastructure, schools and continued action to play our part in responding to the climate and environmental emergencies.”

“I am really pleased that we have been able to achieve all of this while limiting the annual council tax rise to well below inflation in a demonstration of our commitment to delivering value for money as well as excellent services to our residents.”

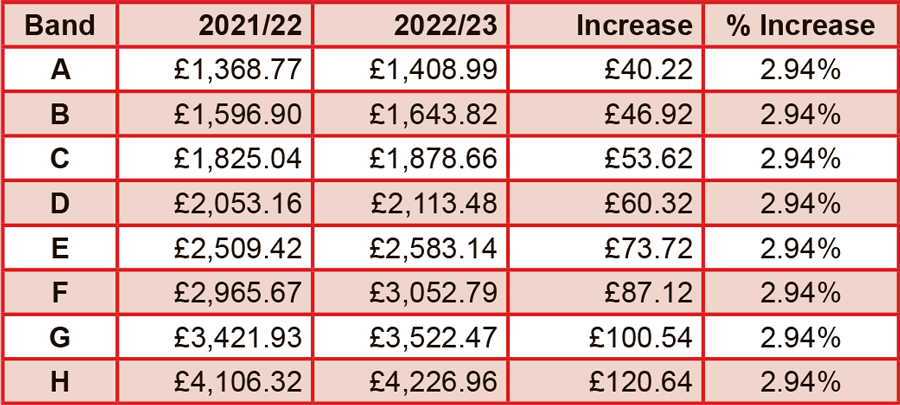

In addition to the South Gloucestershire element, bills that will be coming through letterboxes in the next few days will include contributions to Avon and Somerset Police (up 4.15 percent, on top of a 5.88 percent hike last year) and Avon Fire & Rescue Service (up 1.99 percent), and the precept raised by Bradley Stoke Town Council (no increase this year), producing a grand total of £2,113.48 for a Band D property, an increase of 2.94 percent over last year.

Bradley Stoke

Above: Total council tax figures for Bradley Stoke residents, comprising contributions to South Gloucestershire Council (including special expenses for services not uniformly provided across the district), Avon & Somerset Police, Avon Fire & Rescue and Bradley Stoke Town Council. Figures for other parishes will vary.

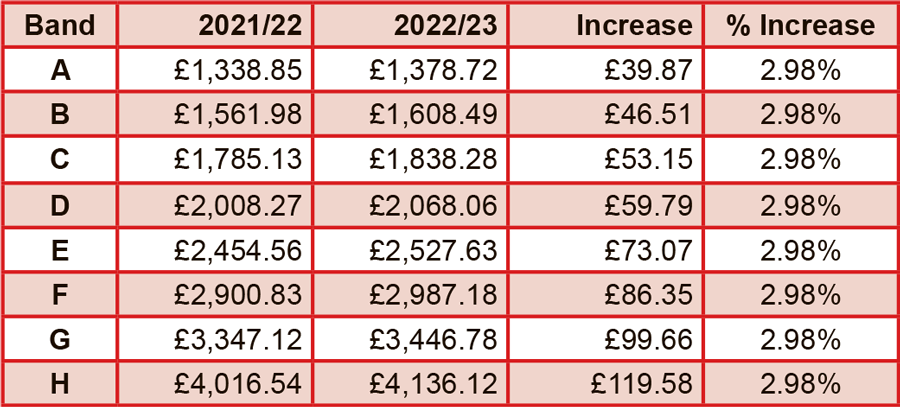

Stoke Gifford

Percentage increases for the individual elements of the tax are as for Bradley Stoke. However, the different level of parish precept in Stoke Gifford results in a grand total of £2,068.06 for a Band D property, an increase of 2.98 percent over last year.

Above: Total council tax figures for Stoke Gifford residents, comprising contributions to South Gloucestershire Council (including special expenses for services not uniformly provided across the district), Avon & Somerset Police, Avon Fire & Rescue and Stoke Gifford Parish Council. Figures for other parishes will vary.

More information about the council tax setting process can be found in reports presented to the Meeting of Council on 16th February 2022.

See also: Where your money goes 2022-23

£150 government council tax rebate

If you live in a property in council tax bands A to D, you are likely to receive a £150 council tax rebate from the government to help with the cost of living.

Read more on GOV.UK Council tax energy rebate: information leaflet for households in council tax bands A-D

Statement from South Gloucestershire Council on 8th March 2022:

“We are working hard to get our systems ready to pay the £150 council tax rebate for those residents in bands A-D, part of the support package from Government, regarding the rise in energy prices. We will update you when we have more information.”

£150 rebate: How and when?

UPDATE added 5th April 2022.

How and when you will get the £150 government council tax rebate (if you are entitled to it)?

South Gloucestershire Council says:

- We aim to pay the rebate from April 2022

- You do not need to contact us about this payment, we will be in touch with you

- If you pay your council tax by direct debit: In most cases the rebate will be paid direct into your bank account

- If you do not already pay by direct debit: You can set it up online. This way we will then have your bank details to make the £150 payment into your bank account

- Otherwise, you will receive a letter towards the end of April or the start of May with details of how you will get your rebate

Full details: How your £150 council tax energy rebate will be paid (South Glos Post)