South Gloucestershire Council’s (SGC’s) element of the council tax levied on local households is to increase by 2.99 percent from April.

The latest rise follows inflation-busting uplifts of 5.99 percent in 2018/19 and 4.99 percent in 2017/18, both of which included a ring-fenced levy of 3 percent to support adult social care.

The social care levy could not be increased further for 2018/19 as the council has already reached the government-imposed cap of a 6 percent cumulative rise over three years.

The increase means that the South Gloucestershire Council element of council tax for a Band D property for 2019/20 will rise to £1,484.

Meeting on 13th February, councillors agreed to set a revenue budget of almost £221 million. The spending plans also include a further £208 million that will be distributed to schools.

The Budget papers show that while the council’s finances are projected to remain in balance for the coming two years, this is only by using reserves set aside for this purpose, delivering additional savings and generating extra income. The council concedes that challenges remain in the medium term, caused by falling government grants and increased costs and demand for services.

Public consultation carried out by the council prior to the budget-setting process showed that 37 percent of respondents expressed a preference for a lower council tax rise for 2019/20 of 1.99 percent, while 36 percent opted for the finally chosen value of 2.99 percent.

The council’s Conservative administration says its budget includes £78 million of investment in local schools and £35m for road and highways (both over four years).

There will also be £3.2m of additional funding for social care, with further increases set aside for extra support to deal with the spike in demand for adult social care seen over the winter months.

Cllr Toby Savage, leader of the council, said:

“Our goal in setting this budget is to ensure South Gloucestershire continues to be a fantastic place to live and work. I’m passionate about improving educational standards and I’m delighted that we’ll be able to deliver such a significant investment in our schools.”

“One of the council’s key priorities is to offer ‘value for money’ to our residents and I believe we are continuing to do so. I am extremely proud that we have not only been able to balance the budget for the next two years, but that we’re also keeping our focus on the quality of services and the delivery of our savings targets.”

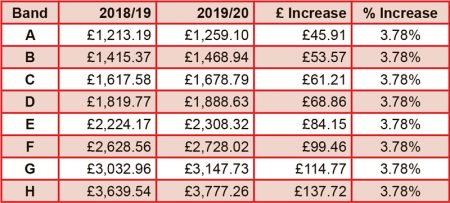

In addition to the South Gloucestershire element, bills that will be coming through letterboxes in the next few weeks will include contributions to Avon & Somerset Police (up 12.38 percent) and Avon Fire & Rescue Service (up 2.99 percent), and the precept raised by Bradley Stoke Town Council (unchanged from 2018/19), producing a grand total of £1,888.63 for a Band D property, an increase of 3.78 percent over last year.

The sizeable increase in the policing element follows a surprise announcement by the government last December to allow police and crime commissioners (PCCs) to increase their levy by £24 a year for a Band D property. It follows a £12 (6.6 percent) rise in 2018/19.

Avon and Somerset PPC Sue Mounstevens said:

“I fully understand that this is a big increase for households. It was not an easy decision. However, I have to balance the challenges facing policing; the increased threat from criminality and the safety of residents.”

“This money will not fix everything but it’s the first investment we’ve seen since austerity began in 2010 and it’s a big step in the right direction.”

From April, the total increase in policing funding after the council tax precept rise and new Home Office funding will boost the PCC’s net expenditure budget by £21 million of which some £17 million is required to meet rising costs. The remaining £4 million of new funds will be invested in the policing service for local residents and tackling local priorities including burglary, drug crime, violent crime and the recruitment of 100 additional officers.

Above: Total figures for Bradley Stoke residents, comprising contributions to South Gloucestershire Council, Avon & Somerset Police, Avon Fire & Rescue and Bradley Stoke Town Council. Figures for other parishes will vary.

The Bradley Stoke variant of this article originally appeared in the March 2019 issue of the Bradley Stoke Journal magazine (on page 35). The magazine is delivered FREE, EVERY MONTH (except August), to ALL 8,700 homes in Bradley Stoke. Phone 01454 300 400 to enquire about advertising or leaflet insertion.

Stoke Gifford

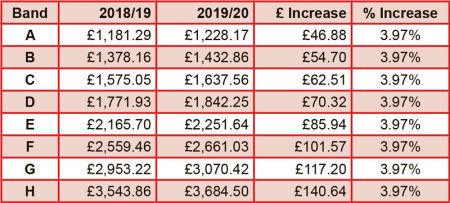

Percentage increases are as for Bradley Stoke, except that the precept raised by Stoke Gifford Parish Council is up 1.6 percent, producing a grand total of £1,842.25 for a Band D property, an increase of 3.97 percent over last year.

Above: Total figures for Stoke Gifford residents, comprising contributions to South Gloucestershire Council, Avon & Somerset Police, Avon Fire & Rescue and Stoke Gifford Parish Council. Figures for other parishes will vary.

The Stoke Gifford variant of this article originally appeared in the March 2019 issue of the Stoke Gifford Journal news magazine (on page 29). The magazine is delivered FREE, EVERY MONTH, to over 5,000 homes in Stoke Gifford, Little Stoke and Harry Stoke. Phone 01454 300 400 to enquire about advertising or leaflet insertion.